EXPOSING the TRISEV Scam

Understanding the TRISEV Scam

The “TRISEV-type” scam is a highly deceptive and sophisticated financial scheme targeting individuals and companies looking to raise capital for international projects and ventures. Posing as a legitimate funding platform in the otherwise highly regulated area of financial services, companies like TRISEV entice victims by promising to help them secure project finance in a relatively fast and uncomplicated manner, usually by invoking extraordinarily high returns on investment and access to substantial capital—claims that are often unsupported and intentionally misleading. The scheme typically employs high-pressure sales tactics, urgent deadlines, and overly complex legal language to convince targets to enter into agreements. Once engaged, victims are manipulated into transferring substantial funds under the false pretense that these are necessary steps to unlock future investment, when in reality, the promised capital never materializes and the investors do not exist. This scam preys on ambition, urgency, and trust, leaving individuals and organizations financially depleted, destroying lives and businesses.

How the Scam Operates

This scam involves the use of purported “strictly private investors” who at first flush appear entirely credible and well-connected, which also allows the fraudsters to avoid the question as to why they are not publicly licensed as financial brokers. Victims are often approached through unsolicited LinkedIn messages or emails, where they are enticed with promises of substantial financial returns and uncomplicated funding opportunities. This is designed to appear professional and persuasive, creating a false sense of legitimacy. In exchange for these services, victims are expected to set aside performance fees at the outset the payment of which will only be triggered upon the fraudster’s promised performance. Once victims have committed their funds to the project, they begin to discover that accessing or withdrawing their money is either severely delayed or completely blocked. In some cases, the funds are misappropriated or embezzled, resulting in substantial financial losses for the victims. In many cases, however, victims do actually receive their funds back, but only after many months or even years have expired, which allows the fraudsters to invest the victims’ financial resources for their own purposes as “debt free” and “interest free” money, which they would not be able to otherwise obtain by normal means because of their lack of access to legitimate capital sources, oftentimes due to strict banking requirements and AML/KYC regulations. Once the fraudsters have recouped the respective amount of the victim’s initial fee contributions as profits on investment, they then regretfully inform the victim that, despite their best efforts, they were not able to fulfill their financial needs. They then return the victim’s money and pocket the excess illicit profits. In these cases, many victims don’t even know that they’ve been scammed. They are strung along indefinitely until the fraudsters are able to eject the now useless clients, who all the while believing that the were merely engaged in an unsuccessful legitimate business venture. The results, however, of such scams are oftentimes just as devastating, as the victims are left with real losses and tremendous opportunity costs.

The fraudsters also often exploit their victims by using the fees collected as a form of debt-free, interest-free capital—funds they would never be able to obtain through traditional financing. They string the victims along, using their money to generate profits, frequently through legitimate business ventures. Once they've earned enough to repay the initial amount, they simply return the original funds with a vague explanation like, “Sorry, it didn’t work out,” while quietly pocketing all the profits. This tactic allows them to avoid legal consequences, as many victims walk away unaware they’ve been defrauded—left only with the emotional impact and the cost of missed opportunities.

People behind TRISEV

These individuals are extremely deceptive and manipulative, posing a serious risk to anyone they encounter. Use the utmost caution in any interaction with them.

Austin van zyl

Business Development Analyst, TRISEV Corporation

Austin Van Zyl, born March 1999 is a Canadian national. The son of known fraudster Christopher Van Zyl, has followed in his father’s footsteps and become actively involved in similar deceptive practices. Reports indicate that Austin plays a central role in the business development and outreach operations tied to their fraudulent schemes, frequently initiating contact with potential victims under the guise of investment or funding opportunities. He is described as brazen and unapologetic in his approach, showing no hesitation in contacting individuals or organizations—often through professional platforms such as LinkedIn or email—with the intent of convincing them to part with money. Like his father, Austin is involved in orchestrating financial scams by presenting seemingly legitimate funding opportunities, which are in fact designed to misappropriate funds. Those who have been approached by Austin Van Zyl or any affiliated entity should treat such communications with extreme caution.

Keep scrolling for more people behind TRISEV...

Christopher van zyl

Senior Director, TRISEV Corporation

Chris Van Zyl (alias), born September 24, 1972, is a Canadian national and known serial fraudster with an active warrant in Canada for multiple financial crimes. Despite claiming to reside in Monaco, he is living in Beausoleil , France. Van Zyl operates under a network of fraudulent entities, most notably TRISEV, along with several other UK-registered companies. His schemes typically involve offering substantial investment or funding opportunities that appear legitimate. Using convincing documentation and professional language, he lures individuals and companies—often those seeking capital—into signing escrow or funding agreements under false pretenses. Victims are promised significant financial returns or funding for their projects, only to find themselves unable to recover their funds, which are often embezzled or diverted.

More People Behind TRISEV

These individuals are implicated in a wide range of serious criminal activities, including but not limited to: identity theft, financial fraud, and suspected money laundering across multiple jurisdictions. They have demonstrated a clear pattern of deception, manipulation, and abuse of trust, often targeting vulnerable individuals and legitimate businesses under the guise of offering investment opportunities or financial services.

Their actions have caused significant harm—financially, emotionally, personally and reputationally—to many victims around the world. These individuals should be regarded as highly dangerous and deceitful. If you encounter any of them or are contacted by them in any professional or financial context, do not engage. Extreme caution is strongly advised.

If you have been harmed or are currently being affected by these individuals. Please reach out to us immediately.

Implicated

INDIVIDUALS

Adelino Hilario

President, TRISEV Corporation

Adelino Hilario, born April 1964, is a Canadian National, the self-proclaimed President of TRISEV Corporation, plays a central role in the fraudulent operations of the organization. Based in Mississauga, Toronto, he presents himself as a highly connected marketing expert and the driving force behind TRISEV’s public image. In reality, Hilario serves as the polished front for a sophisticated and deeply deceptive financial scam. Leveraging his network and smooth-talking persona, he has been instrumental in legitimizing the scheme to unsuspecting victims, contributing directly to the widespread financial harm caused by TRISEV’s activities. This individual should be approached with extreme caution.

FR. George Lagodich

Finance Director, TRISEV Corporation

Fr. George Lagodich, born in April 1960, is a Canadian national and senior priest at St. Nicholas Russian Orthodox Cathedral in Montreal. He maintains strong affiliations with the Russian Orthodox Church Outside of Russia. In addition to his religious role, he is listed as the Finance Director of TRISEV and several associated UK entities. Fr. Lagodich is suspected of facilitating money laundering activities on behalf of TRISEV, using his religious connections to obscure the movement of illicit funds. His involvement raises serious concerns about the misuse of religious institutions for deceptive financial operations. If you encounter this individual or have relevant information, you're urged to contact us.

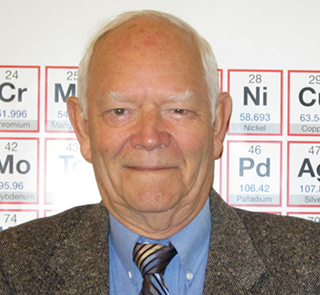

William george davenport

Chairman, TRISEV Corporation

William George Davenport, born in August 1943, is a Canadian national, listed as the Chairman of TRISEV Corporation and is believed to be residing in Vancouver, British Columbia. However, serious concerns have been raised that the identity being used may be stolen, as the real William George Davenport is deceased. Despite this, the individual currently using the name holds official positions in at least six UK-affiliated entities linked to TRISEV. The original William G. Davenport had a distinguished academic career, spanning 43 years as a professor and researcher at McGill University and the University of Arizona, including roles as Associate Dean (Academic) at McGill and Department Head of Metallurgical Engineering at Arizona. It is suspected that the current figure is exploiting these credentials and professional associations to lend legitimacy to illicit financial activities. Evidence suggests he may be involved in laundering money through connections in the mining sector and may be collaborating with individuals posing as financial traders to move and disguise illicit funds.

Jack Davies

Commercial Lending Analyst, TRISEV Corporation

Jack Davies, born in December 1995, is a British national suspected to be currently residing in Portugal. He formerly operated as a commercial lending analyst for TRISEV, where he played a central role in orchestrating deceptive business development schemes. His activities involved targeting individuals and organizations worldwide, luring them into fraudulent financial arrangements designed to extract significant sums under false pretenses. Davies is considered a high-risk individual due to his active participation in complex financial fraud. He poses a serious threat to unsuspecting victims and should be approached with extreme caution. His conduct represents the darkest side of financial deception.

Mohammed Aasim Rajik

Closely Linked to TRISEV

Mohammed Aasim Rajik, an Indian national believed to be residing in the UAE, is the president of Masari Holdings and has known affiliations with TRISEV Corporation, particularly through connections to William George Davenport and Fr. George Lagodich. He is suspected to be a highly sophisticated fraudster. Extreme caution is strongly advised in any interactions with this individual.

Real Stories from Victims

The personal and professional financial devastation caused by the TRISEV scam is substantial and far-reaching. Operating under a façade of legitimacy, the perpetrators have used entities such as Orion Capital Trust, ESBGRP, and various other UK-registered companies to lure victims into fraudulent schemes.

These entities present themselves as providers of elite banking and financial services, claiming they can unlock billions in capital for global projects. Victims are enticed with promises of transformative funding, but only after making substantial upfront payments under the guise of escrow, administrative, or compliance fees. In reality, there is no intention of delivering the promised financial facilities, and once the payments are made, victims often find themselves ignored, misled, or completely cut off—left with significant financial losses and no recourse.

"Chris Van Zyl and Austin Van Zyl operating behind TRISEV have fraudulently exploited my identity and professional reputation in their attempts to deceive and defraud others. Without my knowledge or consent, they embezzled funds from me and misused my personal and financial information to facilitate their elaborate schemes, further enabling their deception and gaining the trust of unsuspecting victims."

Victim 1

United Kingdom

"TRISEV — specifically Chris Van Zyl and Austin Van Zyl — embezzled and misappropriated personal and corporate funds from both myself and my UK entity, over the course of three years for which we we're raising substantial capital for. Their actions were carried out through systematic deception and fraudulent tactics, resulting in significant financial harm and long-term consequences."

Victim 2

United States

"TRISEV has inflicted significant damage on me, my partners, colleagues, and associates through their unscrupulous and deceitful tactics aimed at separating individuals from their money. As a result, I have suffered considerable harm to my reputation, professional career, and well-being"

Victim 3

European Union

How to Report the TRISEV Scam

Gather Evidence

01

Collect all relevant information regarding the scam, including emails, messages, and transaction records. This documentation will be crucial when reporting the scam.

Report to Authorities

02

Contact your local law enforcement agency to file a report. Additionally, report the scam to the Federal Trade Commission (FTC) or your country's equivalent consumer protection agency.

Seek Support from Organizations

03

Reach out to organizations that specialize in fraud prevention and victim support. They can provide guidance and resources to help you navigate the aftermath of the scam.

Share Your Experience

04

Consider sharing your story on platforms dedicated to scam awareness. This can help others recognize similar scams and may assist in gathering data for legal actions.

Understanding the TRISEV Scam

If you or someone you know has fallen victim to the TRISEV scam, it's crucial to understand the nature of this fraud and the steps you can take to protect yourself. This section addresses common questions about the scam, how to identify it, and what legal recourse is available to victims.

Empower Yourself with Knowledge

What is the TRISEV scam?

The TRISEV scam is a fraudulent scheme that targets individuals and companies by promising unrealistic financial returns or services. Understanding its mechanics can help you recognize the signs and protect yourself.

How can I detect if I am being scammed?

Look for red flags such as unsolicited communications, pressure to act quickly, and promises of guaranteed returns. If something seems too good to be true, it probably is.

What should I do if I have been scammed?

If you believe you have been a victim of the TRISEV scam, document all communications and transactions. Report the scam to local authorities, and also contact us via this website, as we are building a case against the directors and shareholders of TRISEV.

Can I take legal action against the scammers?

Yes, victims of scams can pursue legal action. Consult with a legal professional who specializes in fraud cases to explore your options and understand the process.

How can I protect myself from future scams?

Stay informed about common scams, use secure payment methods, and be cautious with personal information. Regularly educate yourself on the latest fraud tactics.

Where can I find support and resources?

There are various organizations and hotlines dedicated to helping scam victims. Reach out to local consumer protection agencies or online support groups for assistance.

Share Your Story

Have you been affected by the TRISEV scam? We encourage you to share your experience with us. Your story can help others recognize the signs of this scam and empower them to take action. Connect with legal resources and find support by joining our community. Together, we can raise awareness and fight against these fraudulent activities.

About Us

We are dedicated to fighting TRISEV and building a case on their financial scams that prey on unsuspecting individuals. Our organization is committed to providing a platform for victims to share their experiences, gather crucial data, and support legal action against these fraudulent activities. With a team of experts and advocates, we strive to empower victims by offering resources, guidance, and a community of support. Together, we can combat TRISEV and protect others from falling victim to their schemes.